Nanny gross pay calculator

To calculate your annual salary multiply the gross pay before taxes by the number of pay periods in the year. Use our nanny payroll calculator to help.

How To Pay Your Nanny S Taxes Yourself Nanny Tax Nanny Payroll Payroll Template

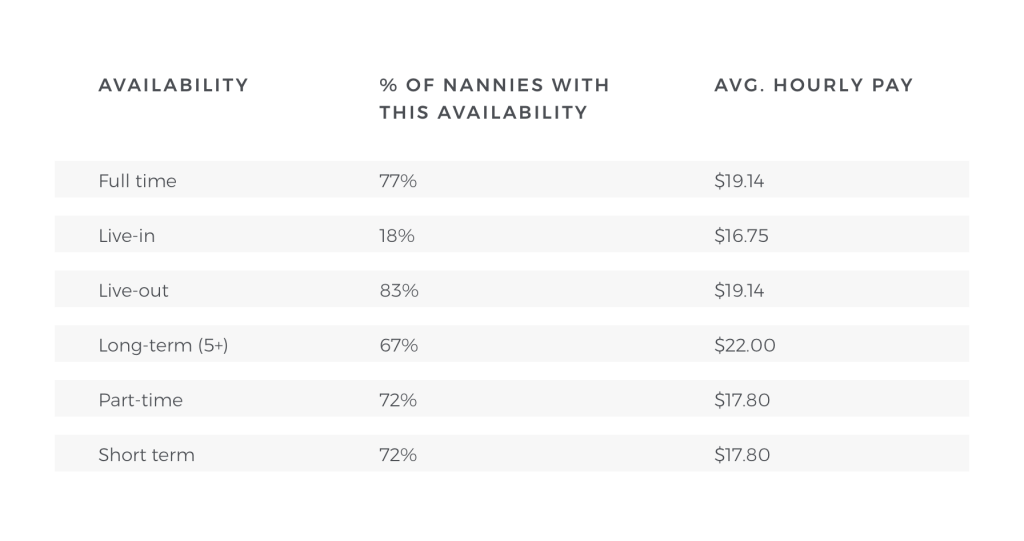

Live-in nannies will typically get paid 350-500 per week net depending on their experience.

. Note that as of 2020 you can pay your nanny up to 2199 gross per year before you both may be responsible for. Sleep easy knowing that the calculation of Net and Gross pay taxes CPP and EI amounts are paid correctly and on time. Mon Thurs.

It doesnt matter from where you hired them or how you pay themif you dictate what their work is and how they do that work theyre an employee according to the IRS. It includes the employee earned without the deductions. That results in your payment of a penalty andor interest to the IRS that you would otherwise not have been required to pay HR Block will reimburse you up to a maximum of 10000.

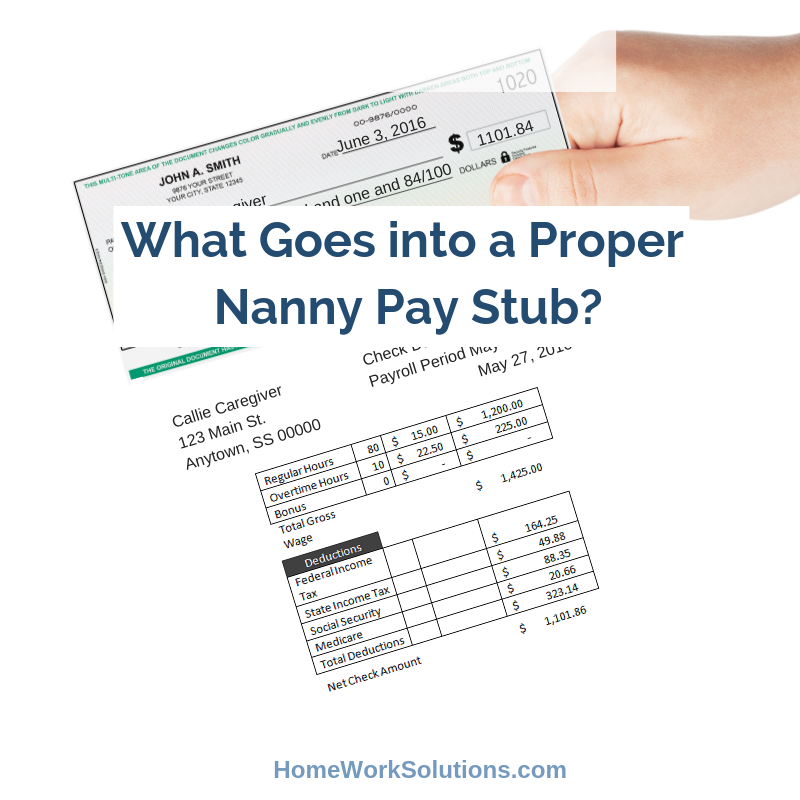

Your pay frequency may differ such as if youre paid bi-weekly semi-monthly or monthly. You need to accurately calculate your nannys gross pay the taxes withheld from them and your corresponding employer taxes each pay period. You can also print a pay stub once the pay has been calculated.

Gross Up Payroll Calculator Or make payroll easy and leave the calculations to us. When it comes to working in peoples homes the working arrangements are often casual and wages are paid out in cash. Gross is the amount before deductions and therefore includes the nannys tax and National Insurance.

File tax returns year-round. The IRS guidelines for what makes your nanny a household employee are pretty simple. Instead use the calculator to see how much net pay the gross offer will generate.

Step One Annual Gross Amount. Gross wages are the amount of money you earn before taxes are withheld. Using SurePayroll payroll becomes as easy as 1-2-3.

As the gross calculator you can calculate it depending on the type of payment a corporate practicesalary or hourly. Easily calculate the take-home Net pay to the employee from a total Gross amount and vice versa. Employees - You will need one that you can use as proof of income when you take out a loan when you rent or as simple as keeping track of your financestaxes.

I was hoping for advice on what the going rate for a nanny. See all in Pregnancy Preparing for a newborn. Ovulation calculator Due date calculator.

BMA Library As a member access a range of e-books and e-journals and use Medline to support your research. For example if you earn 2000. For this we need to use the Take Home Pay section on The Salary Calculator.

Calculate and track payroll. It can also affect your paycheck if you pay more in health insurance premiums to cover a spouse or children. Convert Salary to Hourly Rates of Pay.

The agency or family may have given you a gross figure in weekly monthly or yearly. Typically on a quarterly basis you will need to file state tax returns. If your gross income is below the number on the right you are not required to file a tax return.

GTMs nanny tax calculator should be used solely as a means for obtaining an estimate of tax liabilities but should not be used as a replacement for formal calculations. Federal Withholding FICA Medicare State Withholding Total Deductions. Convert Gross and Net Pay.

Dont be drawn into agreeing a net pay rate. For 2019 the premium is 04 of each employees gross wages. For example if you earn 2000week your annual income is calculated by taking 2000 x 52 weeks for a total salary of 104000.

If you make pre-tax contributions to a 401k a flexible spending account or a pre-tax commuter card those contributions will come out of your earnings. You then list the employees gross wages and select which state youre filing from to calculate state income tax if your state has one which some dont. Get Started For Free.

Hourly Paycheck Calculator quickly generates hourly net pay also called take-home pay free for every pay period for hourly employees. To calculate hourly gross wage multiply the hourly rate and the working hours of the employee. Nanny Payroll Guide Benefits HR Nanny Household.

These premiums will be deducted from each of your paychecks. Use ADPs gross wage calculator to see how much take home pay your nanny can earn before incurring FICA taxes. That said heres a list of who can benefit from our paystub generator.

You dont have to do any payroll calculations we calculate file and pay all federal state and local payroll taxes accounting for all gross pay deductions and withholdings. Any employee pension payments will be deducted from the. Please note that as a nanny employer youre responsible for deductingpaying nannys income taxes and national insurance to HMRC.

What is the difference between gross wages and net pay. Nanny Tax Calculator Cost Calculator for Nanny Employers. Your gross wage determines how much in taxes should be withheld from your pay and how much in taxes the family will have to pay.

A few nannies still expect a net pay rate but net rates are a mistake for both nannies and their employers. Household employment taxes such as for a nanny. To calculate your annual salary multiply the gross pay before taxes by the number of pay periods in the year.

Based on the millions of job posts on the site here are the 2022 average hourly nanny pay rates in several major cities. Deductions from Gross Pay. This is based on the 20222023 tax year using tax code 1257Lx and is relevant for the period up to and including 050722 this will be updated again after this point with the changes detailed in our tax rates and thresholds page.

HeartPayroll is the leading nanny caregiver payroll and tax service in Canada trusted by thousands of families to handle all household payroll needs. To work out monthly to yearly multiply the amount by 12. Having a pay stub comes in handy especially during tax times or when you need proof of income.

Paid leave Disability insurance. Use the calculator below to estimate your premiums. Hours worked in the pay period.

Pregnancy calendar Baby name generator. Nanny pay rate calculator. For employees whose hours of work vary pay is calculated at 5 of the gross wages excluding overtime in the 4 week period immediately before the holiday.

Your nanny is your employee if you control what work your nanny does and how they do it. 350 net per week is approximately 20000 gross a year and 500 net a year is 35000 gross a year. By estimating your nannys earnings youll have a better idea of which taxes may apply.

To use a paycheck calculator you simply enter the information on your employees W-4. Calculate Your Gross Wage. We are looking for a live out nanny to look after my three children when I return to work.

This section wants to know the yearly gross salary. The length that the employee works for the employer does not affect the pay. This grey area can lead to confusion for both parties but determining if a nanny or home-care giver is considered a household employee can make tax filing simpler for everyone involved.

Learning and development Develop your learning by completing our courses on a range of topics which will help you to progress your career. Enter your employees information and click on the Calculate button at the bottom of the nanny tax calculator. Employees that consistently work the same number of hours get one regular work days pay as Stat Holiday Pay.

If you hire a nanny or senior caregiver in California learn about all the state household employment payroll tax and labor laws you need to follow. The calculator automatically calculates the amount to deduct. Gross wages are where the employees pay starts.

How To Calculate Your Nanny Taxes

9 Ways To Stand Out When Looking For A Nanny Job Nanny Jobs Childcare Jobs Nanny

Nanny Tax Payroll Calculator Gtm Payroll Services

Hiring A Nanny Welcome To Being An Employer Sadovnick Morgan Llp

How To Pay A Nanny Caregiver In Canada Net Vs Gross Vs Out Of Pocket Nanny Pay Services For Households Heartpayroll

Prepare Free Nanny Payroll With Our Excel Template Nanny Self Help

Wow So Many Hopscotch Designs Second From The Top Left Corner Is The One I Played My Mom Hand Painted A Per Hopscotch Activities For Kids Nanny Activities

Nanny Payroll Tax Services Canadiannanny Ca

Pay Stub Template Free Employee Handbook Template Templates Printable Free Payroll Checks

What Goes Into A Proper Nanny Pay Stub

How Much Do I Pay A Nanny Nanny Lane

How To Calculate Your Nanny S Pay

How To Calculate Your Nanny S Pay

Access Database For Small Business Payroll Software And Tax Templates Access Database Payroll Software Payroll

Nanny Payroll Tax Services Canadiannanny Ca

Nanny Payroll Tax Services Canadiannanny Ca

Nanny Tax Payroll Calculator Gtm Payroll Services