Depreciation rate percentage calculator

Percentage Depreciation Calculator Asset Value Percentage Period Results The calculator uses the following formulae. When the value of an asset drops at a set rate over time it is known as straight line depreciation.

Car Depreciation Calculator

Subtract the estimated salvage value of the asset from.

. Depreciation rate finder and calculator You can use this tool to. The formula for calculating appreciation is as. Block of assets.

Follow the simple steps given below for the purpose. Depreciation allowance as percentage of written down value. Calculate your fixed asset depreciation rateeffective life.

Depreciation Expense Book value of asset at beginning of the year x Rate of Depreciation100 Depreciation Calculator. This simple depreciation calculator helps in calculating depreciation. How to Calculate Straight Line Depreciation.

After two years your cars value. Step one - Calculate the depreciation charge by using below given formula Depreciation charge per year Asset value - Residual value x Depreciation percentage 3000 - 1000 x 15. The formula of the depreciation and appreciation is the same rates are either below zero depreciation or above zero appreciation.

The Depreciation Calculator computes the value of an item based its age and replacement value. Finds the daily monthly yearly and total appreciation or depreciation rates based on starting and. The MARCS depreciation calculator creates a depreciation schedule showing the depreciation percentage rate the depreciation expense for the year the accumulated depreciation the book.

Our car depreciation calculator uses the following values source. You can browse through general categories of items or begin with a keyword search. A calculator to quickly and easily determine the appreciation or depreciation of an asset.

Annual Depreciation Cost of Asset Net Scrap ValueUseful Life Annual Depreciation 10000-10005 90005 1800year Annual Depreciation Rate. Depreciation rate refers to the percentage at which. Choose whether you want the calculated information for years or months by selecting the respective option Enter the asset value.

The straight line calculation steps are. Lets take an asset which is worth 10000 and. This unique AssetAccountant search tool allows you to search fixed assets to determine the appropriate fixed asset depreciation.

Rates of depreciation for income-tax AS APPLICABLE FROM THE ASSESSMENT YEAR 2003-04 ONWARDS. Find the depreciation rate for a business asset calculate depreciation for a business asset using either the diminishing value. Determine the cost of the asset.

Straight Line Depreciation Calculator. After a year your cars value decreases to 81 of the initial value.

Depreciation Calculator Definition Formula

How To Use The Excel Db Function Exceljet

Depreciation Rate Formula Examples How To Calculate

Depreciation Rate Formula Examples How To Calculate

Depreciation Rate Formula Examples How To Calculate

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Car Depreciation Calculator Calculate Depreciation Of A Car Or Other Vehicle

Depreciation Formula Calculate Depreciation Expense

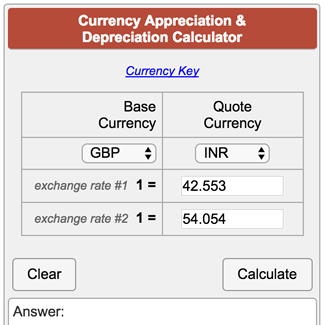

Currency Appreciation And Depreciation Calculator

Declining Balance Depreciation Calculator

Straight Line Depreciation Formula And Calculation Excel Template

Depreciation Calculation

Depreciation By Fixed Percentage Youtube

Reducing Balance Depreciation Calculator Double Entry Bookkeeping

4 Ways To Calculate Depreciation On Fixed Assets Wikihow Fixed Asset Asset Calculator

Depreciation Formula Calculate Depreciation Expense

Annual Depreciation Of A New Car Find The Future Value Youtube