Calculate book value of equipment

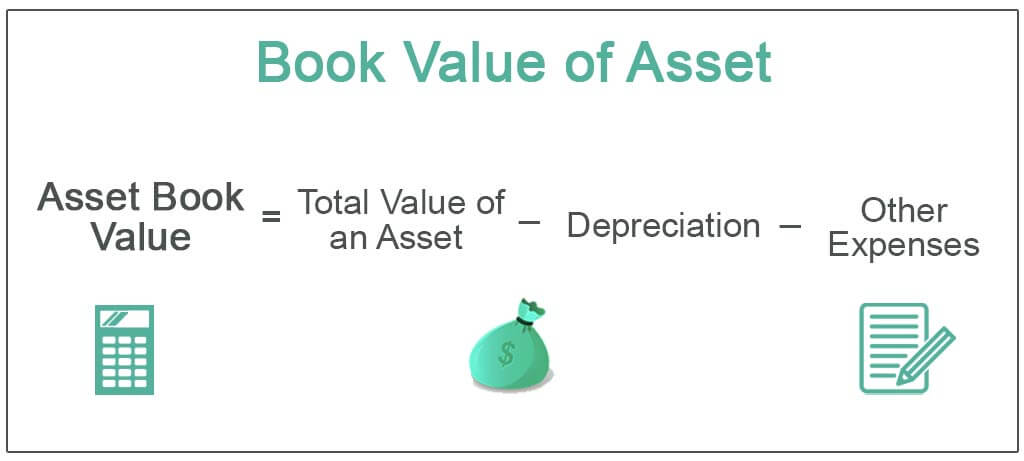

To compute for book value four essential parameters are needed and these parameters are present amount or worth P salvage value S total estimated life of the asset. To calculate the book value of an asset you subtract its accumulated depreciation from its original cost.

How To Calculate Book Value 13 Steps With Pictures Wikihow

There are three important formulas for book value.

/ScreenShot2022-03-08at4.53.06PM-eda6eb2099b245129240ed8ef9d984ed.png)

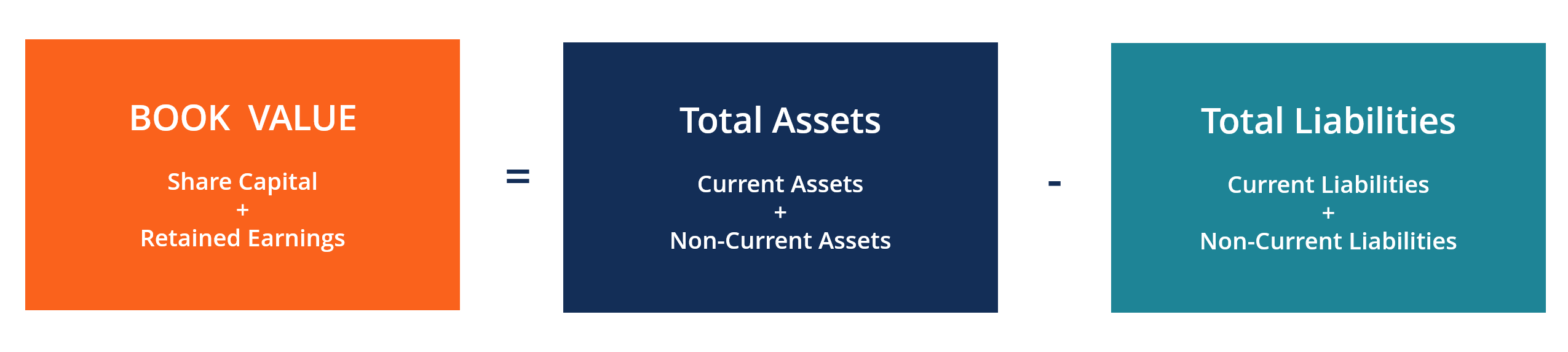

. You calculate book value by totaling every asset a company possesses and every liability that the company holds. As a result book. Here is the book value formula for an individual asset.

Book Value Assets Original Cost Depreciation Lets say you bought a car. We advise setting up the current book value of each. You can calculate the value of your equipment stock by exporting your equipment and making the calculations in Excel or Google Sheets.

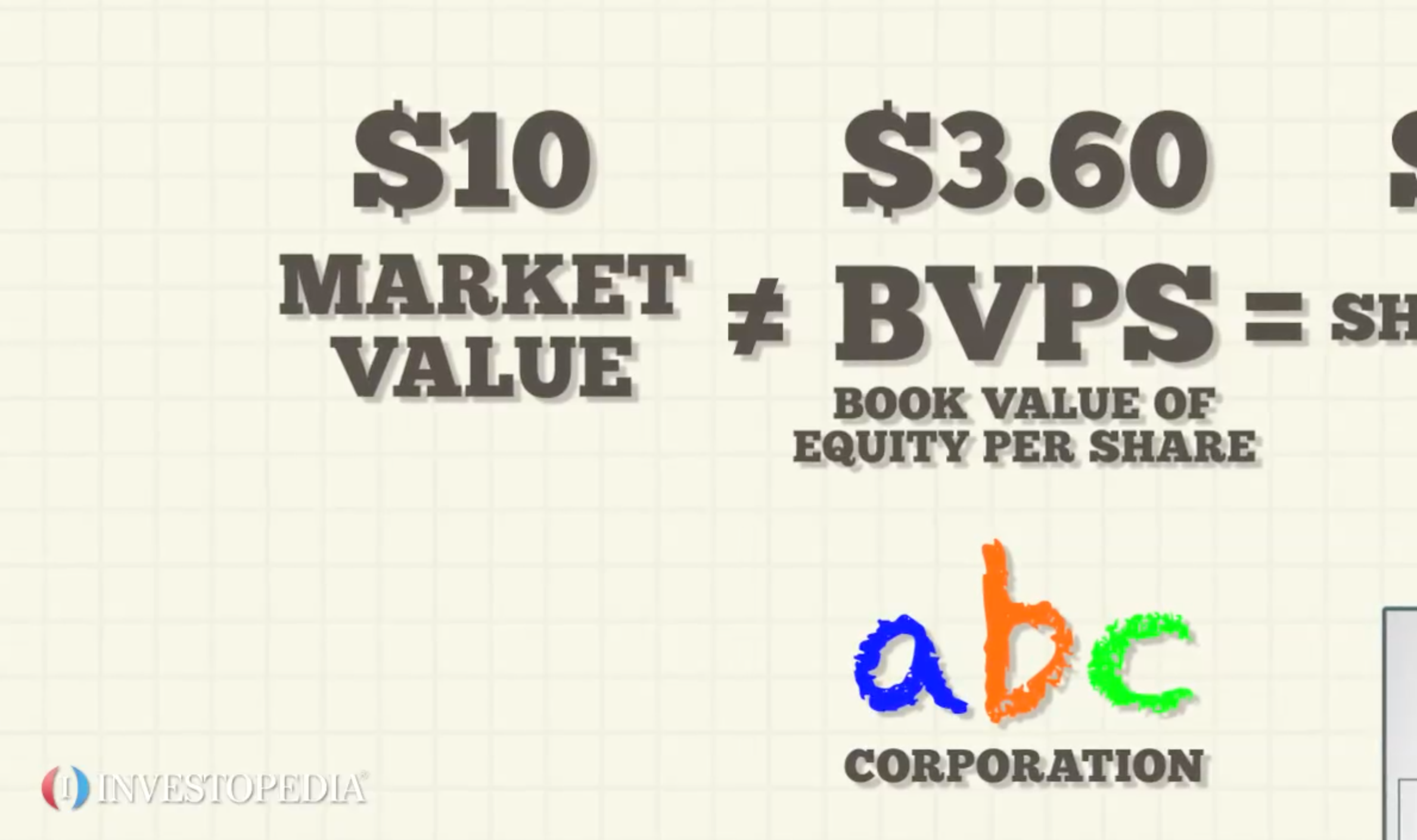

Check prices for your favorite vehicles. Depreciation per year Book value Depreciation rate Double declining balance is the most widely used declining balance depreciation method which has a depreciation rate that is twice. Book value is the net value of assets within a company.

Click Items next click on one item Click Depreciation Fill in the items purchase price and its purchase date Fill in the items residual value The items Book value will automatically be. By subtracting the total liabilities from the total assets you. Check prices by MAKE MODEL AND YEAR.

Its original cost was 20000 and. If the logging company purchased the truck for 200000 and the truck depreciated 15000 per year for 4 years the calculation of NBV would look like below. Book value per share is calculated by taking shareholders equity and dividing it by the number of shares outstanding providing book value on a per-share basis.

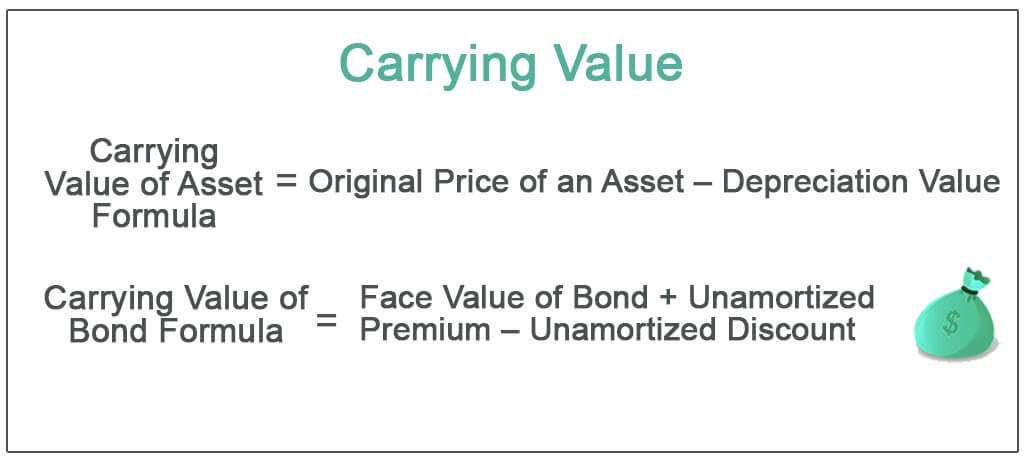

Well show you the average lowest. Book value is equal to the cost of carrying an asset on a companys balance sheet and firms calculate it netting the asset against its accumulated depreciation. The formula used to calculate the net book value of the assets is as below.

Book value of an asset total cost - accumulated depreciation. To calculate the book value of a company you subtract the value of its. Book Value Acquisition Cost - Depreciation Back to Equations What is Book Value.

Book value is an accounting term used for both a measure of a businesss equity and the value of an asset as it appears on a balance sheet. Book value of a company assets - total liabilities. In the UK book value is also known as.

Its a quick way to find out the range of listed prices for your search. In the case of a business book value is usually. Net Book Value formula Original Purchase Cost Accumulated Depreciation You are free to use this image.

Book Value Of Assets Definition Formula Calculation With Examples

Straight Line Depreciation Accountingcoach

Book Value Of Equity Formula And Calculator Excel Template

Book Vs Market Value Key Differences Formula

How To Calculate Book Value 13 Steps With Pictures Wikihow

How To Calculate Book Value 13 Steps With Pictures Wikihow

Book Value Formula How To Calculate Book Value Of A Company

What Is Book Value Definition How To Find It Use In Investing

How To Calculate Book Value 13 Steps With Pictures Wikihow

Book Value Definition Importance And The Issue Of Intangibles

Net Book Value Meaning Formula Calculate Net Book Value

Book Value Per Share Bvps Formula And Ratio Calculator Excel Template

Carrying Value Definition Formula How To Calculate Carrying Value

Book Value Of Equity Formula And Calculator Excel Template

/ScreenShot2022-03-08at4.53.06PM-eda6eb2099b245129240ed8ef9d984ed.png)

Book Value Vs Market Value What S The Difference

How To Calculate Book Value 13 Steps With Pictures Wikihow Book Value Calculator Life

How To Calculate Book Value 13 Steps With Pictures Wikihow